Top Tools for Insurance Document Generation in 2026: Perfect Doc Studio, PandaDoc & Windward

Insurance document automation is the process of using technology to handle faster, easier, and effective insurance documentation. This covers records such as customer letters, contracts, underwriting reports, policy applications, and claim forms. Insurance employees spend 22% of their time on manual, repetitive tasks like re-entering data. This would include the various insurance documentation that are required on a day-to-day basis.

It seems ridiculous not to automate such monotonous tasks today. That is why insurance companies save time and reduce manual labor by using developed tools like artificial intelligence (AI), optical character recognition (OCR), natural language processing (NLP), and smart data extraction to automatically read and understand data.

One might think that it would cost a lot to employ so many tools and features, but the truth is far from that. Take Health insurers as an example, they report an average claims-processing error rate of 19.3%, meaning nearly one in five claims contains mistakes. Commercial insurers fare slightly better with 7% error rates, but every error costs an average of $25 per claim to fix. Amongst the millions of claims that are being processed on a daily basis, imagine spending $25 per claim to fix the errors, adding to that the time it would take up from your employees.

An insurance documentation or insurance document generation tool can save a company millions of dollars. If you’re still unsure, keep reading to find out how to reduce insurance paperwork, speed up claims document processing, and eliminate manual insurance data entry, all while maintaining compliance.

Key Takeaway:

- Insurance document automation saves time and reduces manual errors by streamlining processes like claims, underwriting, and policy management using tools such as AI, OCR, and NLP.

- Tools like Perfect Doc Studio, PandaDoc, and Windward offer specialized features like eSignatures, multilingual support, and system integrations that improve document accuracy, speed, and customer communication.

- Automation improves efficiency and compliance by securely managing sensitive data, integrating with core insurance systems, and helping insurers stay up to date with evolving regulations.

Insurance document automation has many benefits and helps in automating the process:

● It helps in extracting data from unstructured or semi-structured documents.

● Helps in validating the data by cross-referencing.

● It helps in organizing the content of the document.

● Use automation to handle tasks like forwarding documents automatically.

● It integrates with other business systems such as CRMs or policy management.

Read our guide on Insurance Customer Communication Management for insights into platform comparisons and segment-specific references.

Let’s Look at Some Common Challenges and How Insurance Document Generation Can Address Them

Document Creation Speed

This has been an age-old issue since the dawn of digitization. It is painfully slow, and reviewing and cross-checking take hours. More so if you’re drafting policies, proposals, and correspondence from scratch.

The solution, of course, is modern document generation platform that use intelligent templates and integrate data to automate the creation of professional documents. These documents are compliant, don’t need any human checks, and the best part? They adjust content based on policy types, coverage amount, customer data, and the rules that are pre-defined by you.

Data Accuracy and Consistency

It is humans who manually enter data, leading to errors. To err is human, and we cannot separate the two. The result? Absolutely costly–claim denials, compliance violations, and customer dissatisfaction.

Automation is the solution. Moving beyond copy-pasting, automated systems pull data directly from CRMs, business systems, or integrated data systems that eliminate transcription errors. There are business rules set in place to ensure consistent formatting and inclusion of required information across all documents.

Compliance and Regulatory Requirements

Insurance documents must meet strict regulatory standards. But these standards keep evolving, even on a daily basis. What was considered a regulation today might change tomorrow. Can your employees stay on top of every regulatory change that’s happening across the industry?

Compliance checks are now built into every system, as well as the template library, to ensure that any change is instantly updated across the library. Such automated updates keep templates current with changing regulations.

Multi-Channel Document Delivery

The evolution of the digital era means customers want to receive their correspondence through their preferred channels, and sometimes, it is across multiple channels, for instance WhatsApp, Emails, and postal mail.

Modern platforms support omnichannel delivery, formatting them automatically. They send them through different delivery methods, while maintaining branding and consistency.

Best use cases for the insurance industry:

It is fast and efficient claims processing for many insurance companies, yet it’s often time-consuming, as it operates manually, which can be a little difficult for both insurers and customers.

Claim processing takes several days as insurance agents have to gather and check data from multiple sources, like,

● Medical certificates for health insurance claims.

● Travel loss claims.

● Police reports, driver’s licenses, and vehicle damage photos to claim insurance.

Implementing an automated claims processing workflow, including claim intakes, claims assessments, and claim settlement, speeds up claims-related operations. It reduces 80% of the manual work, indeed, which allows the companies to process twice as many claims.

Intelligent automation improves insurance policy management by automating tasks such as policy insurance and other updates. It is a critical function that covers an entire industry of insurance policies.

It includes activities such as policy issuance, policy updates, and policy management to ensure accurate and up-to-date records and compliance.

It also enhances other document-intensive processes, such as loss run report processing and managing statements of value.

It is an organization’s process that follows all the rules and laws set by the government and industry regulators. Insurance companies ensure that they handle customer information properly and operate transparently. The tasks include researching customer details, ensuring legal compliance, and maintaining the security and confidentiality of customer data./

Insurers safeguard their clients and build trust by concentrating on regulatory compliance. It also aids in avoiding fines and other legal issues.

It is simpler to stay current with evolving regulations and safeguard customer information when compliance tasks are managed by technology.

This includes customer research, compliance checking, and customer data security

Automated underwriting is a transformative insurance industry that is boosting accuracy and speed in the key operation. It involves a lot of information gathering and analysis from various sources to detect the risk for a particular policy.

Implementing this solution to automate insurance writing will speed up functions like data collection, internal systems updates, loss runs assessment, customer claims history, and much more. There are many alternative underwriting software programs, like Majesco underwriting, Appian underwriting workbench, and many more.

Tools that support insurance document generation

Perfect Doc Studio

Perfect Doc Studio stands out as an ideal tool that helps insurance core systems with the document generation process. Most tools like Guidewire, Sapiens, Duckcreek, and others primarily focus on the insurance lifecycle. Unfortunately, these tools have limited insurance document generation capabilities. Perfect Doc Studio helps bridge the gap that these tools have through its native integration engine, enhancing document generation capabilities. It uses a no-code, drag-and-drop builder and advanced workflow and automation to make document automation accessible to business users without any technical expertise.

Key Features For Insurance Document Generation in Perfect Doc Studio

● Drag-and-drop builder is suitable for non-technical users, helping them create complex templates without any coding expertise. The insert/onsert feature lets you add pdfs at any point in the workflow.

● The template library is vast, and with the reusable sections and pages, adding repeated content to your documents becomes quick and easy.

● With conditional logic and business rules, content adapts dynamically based on customer data, policy types, and pre-defined rules.

● PDS is GDPR, HIPAA, and ISO compliant, offering enterprise-grade security at a fraction of the cost.

● The global support it offers is unmatched, with contextual AI translations in 108 languages.

● You can send documents through WhatsApp, email, SMS, Print, and Fax.

● Users can include various dynamic elements like personalized images, QR and barcodes, data driven charts, and more.

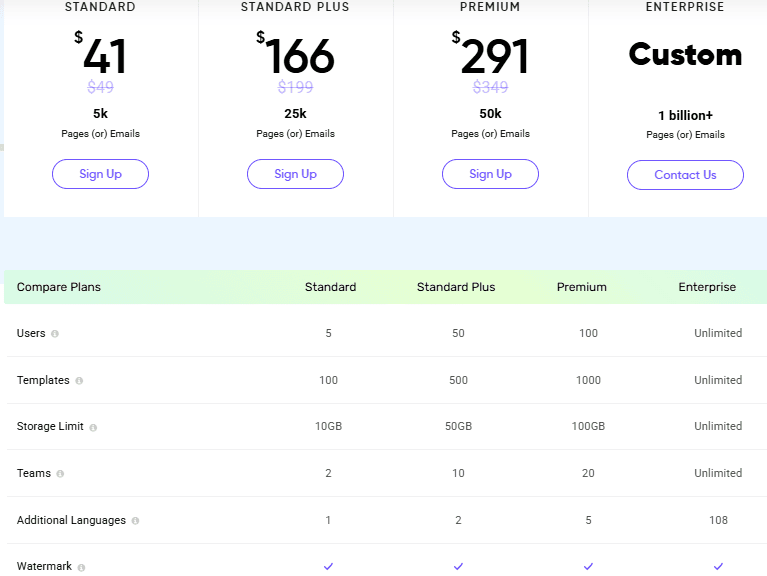

Perfect Doc Studio’s Pricing and Plans:

PandaDoc

PandaDoc is designed to integrate with your CRM and storage, supporting your team with what you are already familiar with. It provides an insurance generation process with a user-friendly editor that allows users to create professional-looking insurance documents easily

Some templates can be filtered based on the user’s needs, especially when exploring the creation of an insurance document independently.

Key Features For Insurance Document Generation in PandaDoc

● Speed up your claims process by eliminating delays associated with scanning and signing.

● Reduce errors during the document creation with the help of an extensive library of integrations.

● There are smart ways, like claim documents and quotes, with the help of a customizable template library that guides users through the process.

● The capability that changes the way your customers interact better is through built-in eSignatures, without having to print or download an app.

Pros according to users:

● E-signature automation helps to ease the whole process from creation to signing.

● Strong document management helps in saving time and consistency. Additionally, the prebuilt templates are of great help to the non-technical people.

● Integrations that work well with CRM and other tools, like Salesforce, can reduce manual work and maintain data.

What people complain about:

● For small businesses, the pricing can be as steep as you can scale.

● There is occasional lag in the IU cases, especially when the documents are in larger amounts.

● Users have found that the support can be slow, and the higher-paid plans are available only via ticket and not over the phone.

For more detailed reviews from users, check out the PandaDoc reviews on G2

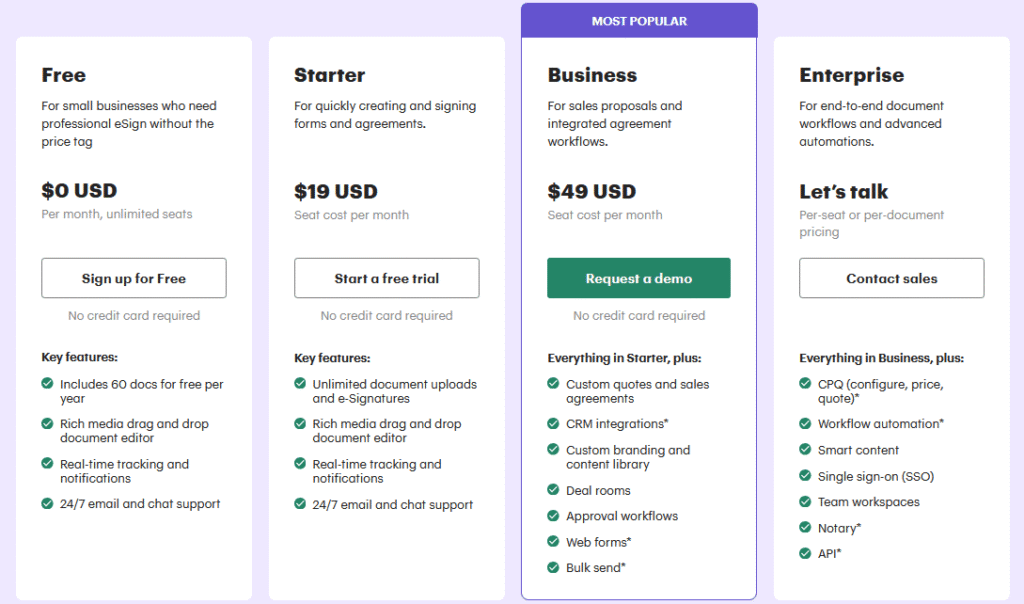

PandaDoc’s Pricing and Plans:

Windward

Windward is known for error-free document automation for insurance firms. It features a rich platform with a user-friendly interface to enhance the efficiency of the workflow during the insurance documentation process. Creating a data template is easier by using flexible integration, such as Microsoft Word or Excel, and available data from the system.

As the process is easy to implement, users like insurance brokers, underwriters, and carriers can relax about the quick automation of policies, letters, insurance cards, and other relevant documents.

Key Features For Insurance Document Generation in Windward

● Using Windward, you can create documents by using the available templates designed for formatting the text editors and customise the document as per your needs.

● The data entries are very flexible in terms of text, images, and signatures as well.

● Security is one big advantage, as only authorized users are allowed to design, edit, and delete templates.

● The integration of cloud storage makes it easy to access the documents.

Pros according to users:

● Inventory & order tracking – many users appreciate the inventory management capabilities.

● The functionality of the point of sale – the features have been praised.

● It has all-in-one business management abilities like integration with POS, CRM, and other insurance process functionalities.

Where it falls short:

● There are UI that are outdated and have performance issues.

● Windward has issues with reporting certain financial or accounting tasks.

● There are users who complain about the customer service being slow and unhelpful.

For more detailed reviews from users, check out the Windward reviews on Capterra.

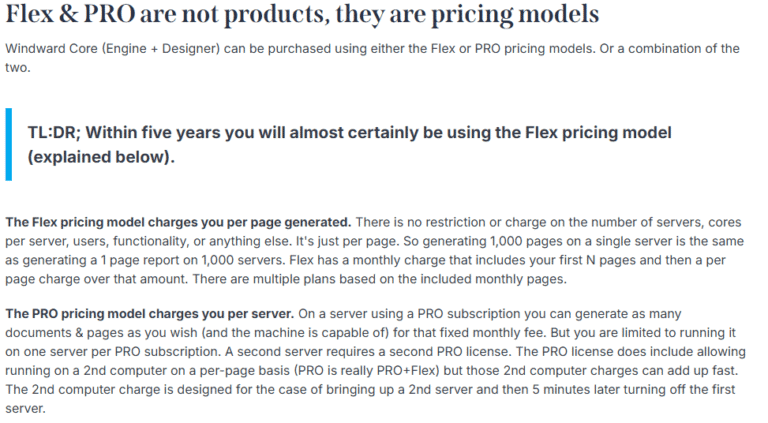

Windward’s’s Pricing Models:

Compare automation leaders and see which platforms offer the best features for insurance firms in Top 5 Contract Automation Tools: Features & Pricing

Conclusion:

Automating insurance documents makes it easier for insurers to manage everything from policy updates to claims. Businesses can decrease manual labor, expedite procedures, and increase accuracy by utilizing tools like PandaDoc, Windward, and Perfect Doc Studio. It’s a more intelligent approach to document management, time savings, and customer service.

FAQs

It’s the use of technology to create, manage, and send insurance documents automatically.

This includes policies, claims, customer letters, and more.

Automation reduces manual work and improves accuracy.

It helps teams save time and avoid repetitive tasks.

It also ensures documents are delivered faster and consistently.

Automation speeds up data collection and validation from claim forms.

It reduces manual checks by pulling info from multiple sources.

This means faster claim assessments and fewer delays.

It also helps insurers handle more claims with the same staff.

Overall, it improves the experience for both insurers and customers.

Yes, platforms like Perfect Doc Studio support over 100 languages.

They can personalize documents based on the customer’s language.

This helps serve diverse customers more effectively.

It also ensures clear communication across regions.

Multilingual support is key in global insurance operations.

Most tools offer native integration with CRMs, policy systems, and more.

For example, Perfect Doc Studio connects with Guidewire and Sapiens.

This allows for seamless data flow between platforms.

You don’t need to switch systems to benefit from automation.

Integration helps maintain accuracy and saves time.

Yes, security is built into most modern automation platforms.

Only authorized users can access or edit templates and data.

Data encryption and user controls help protect sensitive info.

This is important for compliance with industry regulations.

Security ensures customer trust and legal safety.

Confirmation Email Design, Examples, and Best Practices

As a consumer, have you ever made a purchase or signed up for a service, only to wonder if your acti

Automated copywriting: Can it reduce the cost of email generation?

In digital communication, one revolutionary leap that has caught the attention of marketers and busi

Best Insurance Agency Software for Your Business Needs

This blog explores the need for a specialized insurance agency software in 2025, highlighting the va