The Complete Guide to Insurance Customer Communication Management (CCM) in 2025

Insurance is a regulated sector where communication between the organization and the customer is vital to building trust. We forget that these aren’t just numbers or names on a screen; behind every policy, every claim, every renewal is a real person who just wants to get all the correct information on time.

Customers, too, have seen how technology has made their lives easier. They expect the same ease and convenience from their insurance providers. However, regulatory requirements are growing more complex while customer expectations escalate. Suddenly, insurance-related communication is a make-or-break part of the customer experience. Now add the complexity of policy drafting, regulatory requirements, renewals, and the emotional stress that typically accompanies claims, and timely and clear insurance communication is an absolute need.

A Salesforce report found that 52% of customers say companies are generally impersonal, despite 73% expecting them to understand their needs and expectations. Moreover, 54% of customers say that companies need to transform how they engage. Stats like this really emphasize and elucidate how vital personalized communication is and it role in addressing customer pain points and needs. Insurance communication isn’t only about sending emails or printed documents. It includes multifaceted aspects, such as crafting timely, personalized, and omnichannel experiences.

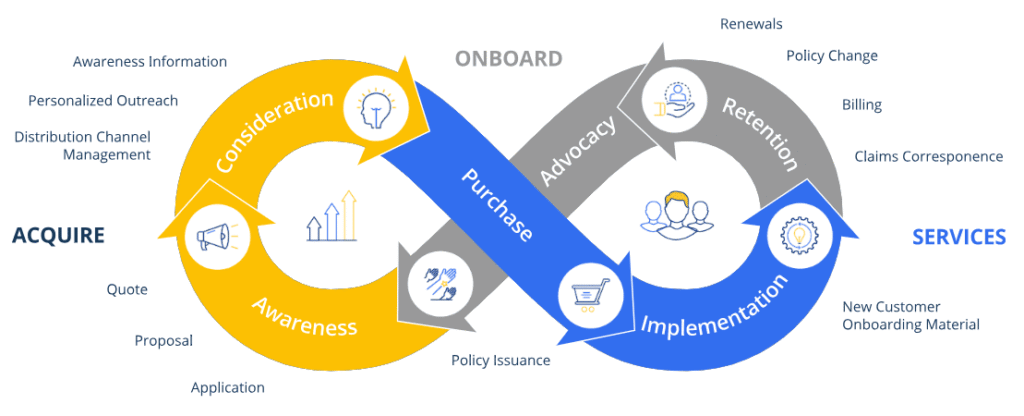

Insurance Customer Communication Management (CCM) is a powerful engine that delivers excellent customer experiences (CX). It assists insurers in driving growth, ensuring compliance, and building customer loyalty.

Insurance Customer Communication Management has evolved to meet the needs of today’s customers. From a back-office administrative function to the need of the hour, it influences profitability, compliance, and, more importantly, serves as a market differentiator. You would’ve heard of how customer communication management software are becoming more popular. Insurance customer communication management, on the other hand, is a communication tool specifically designed for the insurance sector’s engagement needs.

What’s the Difference Between CCM and Insurance Customer Communication Management?

At its core, both are communication management systems. CCM is an approach and a suite of tools to create, manage, and distribute customer communications across various channels. Insurance Customer Communication Management does all of this and more. It encompasses specialized functionality designed to address the unique challenges in insurance communication. To list a few, policy information, claims processing, regulatory compliance, and customer service inquiries necessitate a specialized approach.

Key Difference

| Aspect | General CCM | Insurance CCM |

|---|---|---|

| Focus | Broad, industry-agnostic | Tailored for insurers |

| Compliance Needs | Varies by industry | Strict regulatory and legal requirements |

| Content Types | Marketing, billing, general notifications, routine communications | Policies, claims, underwriting documents, compliance notices, and insurance-related communications |

| Customer Journey | Simple, linear, or customizable | Complex, multi-touch, long-term engagement |

| Data Integration | Often CRM-based, API-integrated data sources | Includes legacy systems, policy admin systems, core platforms, API-integrated data sources |

For a deeper understanding of how such systems work together, check out our blog on Customer Relationship Management Communication.

Let me paint you a picture of how Insurance Customer Communication Management can assist business users:

- The level of complexity dealt with in insurance documentation is quite dense and highly regulated. Policies and claims can’t just be drafted and sent along a friendly email. It requires meticulous preparation, and ‘winging it’ won’t cut it.

- Insurance is a field where business users must regularly interact with highly strung people, managing claims related to accidents, illnesses, or natural disasters. Communications should prioritize transparency while remaining empathetic.

- Timing and accuracy are pivotal as insurers must communicate at the right moment. Information like renewals, policy changes, and claims updates must be communicated precisely, quickly, and securely.

These are just a few situations where insurance customer communication management truly shines. Of course, a general CCM tool primarily communicates, but insurance customer communication goes one step ahead by delivering information with empathy, clarity, and compliance.

Learn more about the benefits of implementing these systems in our blog on the benefits of customer communication management.

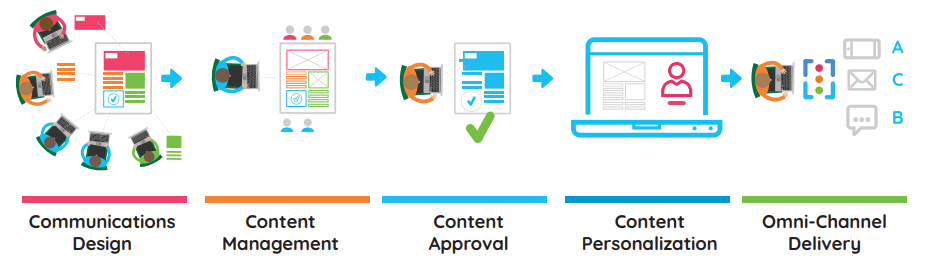

Components of Insurance CCM: What’s in the Toolbox?

Effective insurance CCM is like a machine that has various parts and structures with clearly defined roles and workflows. Let’s break it down:

1. Document Generation: Creating customized documents such as policies, welcome kits, claim letters, and much more. Insurance CCM’s document generation capabilities can auto-fill a complex form with 100% accuracy every time.

2. Omnichannel Communication: Customers expect communication on their terms, their preferred channels, and on their time. Regardless of whether it is an email, text, print, mobile apps, or even chatbots, consistency and convenience are prioritized.

3. Templates and Branding: The tool ensures that every outbound communication has a consistent look, feel, and tone of voice. In cases where different departments collaborate or send messages to the same client, it remains the same. Moreover, they have a customizable template and content repository.

4. Data Integration: The platform leverages customer data from various systems, including CRMs, policy systems, claims platforms, and other data sources. Pulling data from practically everywhere gives the personalization incentive.

5. Compliance Management: The insurance niche has various legal and regulatory standards. Meeting all the standards is no easy feat in a tightly governed landscape. For instance, Messagepoint offers a specialized life insurance customer communication management platform that specifically addresses regulations in the life insurance domain.

To explore the latest trends in this area, visit our blog on customer communication management trends.

Must Have Insurance Customer Communication Management Tools

Below is a list of standout CCM tools built for the needs of insurers.

SmartCOMM for Insurance by Smart Communication

Key Features

1. Omnichannel Capabilities

The platform delivers personalized communication, anything from policy updates to claim notifications, across SMS, email, print, voice, and chat.

2. Adaptive Forms and Interactive Experiences

The solution inserts personalized content based on customer data, and users can generate intelligent, adaptive forms. It also facilitates on-demand document generation related to claims, policies, and billing communications.

3. Business-Controlled Template Design

The user-friendly interfaces support browser-based template authoring across multiple channels, brands, jurisdictions, and languages, reducing template sprawl and maintenance costs.

4. Secure Archival and Retrieval

SmartCOMM™ acquired Joisto, a secure cloud-based archival and retrieval solution that ensures communication records are compliant and easily accessible.

5. Core System Integration

The solution comes with pre-built connectors for insurance platforms, accelerating implementation and deployment. It also includes an API-driven architecture designed to plug into the broader insurance tech stack for enterprise-level connectivity.

Gartner Review: 4.7/5 (69 Reviews)

Strengths: Users commend SmartCOMM for its document generation capabilities, including personalized communications. The user-friendly interface and strong integration with existing systems are frequently highlighted, along with effective support (community site) and training resources provided by the vendor.

Limitations: Common complaints include the product’s high cost, a steep learning curve for new users, and occasional performance issues with large document processing. Some users also mention that the software can be complex to configure, resulting in a lengthy implementation time.

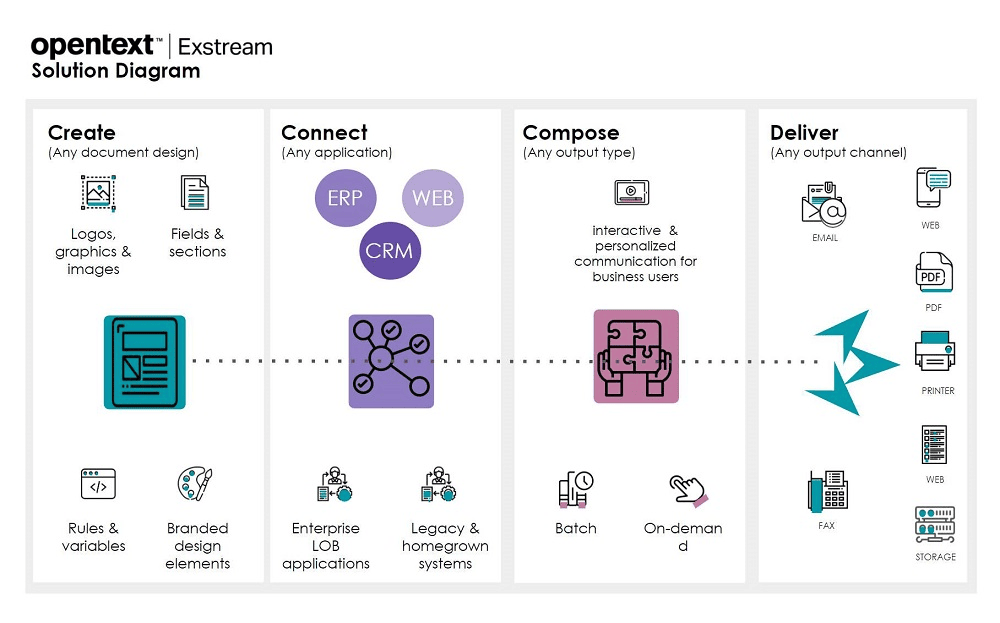

OpenText™ Exstream™ for Insurance

OpenText Exstream is a CCM solution designed for the insurance industry that enhances customer interactions. This software allows business users to design and deliver personalized, highly engaging experiences. OpenText enables insurers to leverage customer data to create cohesive communication strategies across all touchpoints throughout the customer lifecycle. With deployment options including on-premises, cloud (private and public), and hybrid implementations.

Key Features

1. Business User Empowerment

The solution provides non-technical users with intuitive authoring tools to create, edit, and personalize content without requiring IT involvement. Through responsive design, the platform manages the scale and flow of communication, regardless of device or screen size.

2. Centralized Content Management

Exstream’s centralized repository includes communication templates and content assets to maintain consistency. It also assists in managing variable content components across all customer touchpoints.

3. Regulatory Compliance Support

The compliance management tools automatically incorporate appropriate content based on effective dates and jurisdictions. It adheres to various regulatory requirements including GDPR and state specific regulations.

4. Advanced Personalization

The solution creates highly personalized communication with various features, including data-driven charts and graphs that simplify complex information in renewal letters, statements, and policy documents.

5. Integrated Customer Journey Management

OpenText offers complementary solutions for digital asset management, web content management, and other customer experience tools to provide a complete, 360-degree view across all touchpoints.

6. Implementation and Support

Implementing OpenText Exstream means you get to leverage Experience advisory services and implementation assistance, user adoption support, and integration and modernization services.

Gartner Review: 4.2/5 (73 Reviews)

Strengths: Users appreciate OpenText Exstream for its document creation and management capabilities, particularly its flexibility in designing personalized and omnichannel communications and its ability to record calls. The software’s strong integration with other systems and the quality of customer support are well-liked.

Limitations: Common issues include a steep learning curve for new users, challenges with the initial setup process, and dependence on IT experts. Some users report performance issues when handling large volumes of documents, and a few have noted that the user interface could be more intuitive and advanced. They claim the solutions need to be upgraded.

Quadient Inspire For Insurance

Quadient Inspire is a fully integrated, enterprise-grade CCM platform for insurers. It helps insurance professionals create, manage, and distribute complaint and omnichannel communications from a unified hub to their policyholders, agents, and brokers. With the flexibility to deploy on-premise, in the cloud, or via a hybrid model, Quadient Inspire is built to scale with your organization.

Key Features

1. Multi-Channel Support

The platform delivers personalized, compliant communication from a centralized platform, eliminating the need for separate systems. It covers print, email, SMS, mobile apps, and web portals.

2. Dynamic Content Capabilities

The platform supports interactive elements like charts, graphs, and sliders, making complex information easily digestible. IT can also pre-populate digital forms with customer data, streamlining processes from acquisition and onboarding to claims handling.

3. Customer Journey Mapping

The platform improves the customer journey by mapping and connecting all your customer communications to your journey maps. This gives you a holistic view of the entire customer journey and its various touchpoints.

4. Compliance Management

Quadient’s governance features enable compliance, legal, and line-of-business teams to collaborate throughout the communication creation and approval process. It supports Data integration from multiple sources, template standardization with business rules, product and location-specific regulatory content, and Comprehensive approval workflows with audit trails

5. Quadient Mobile Advantage

This platform extends Inspire’s capabilities to mobile apps and web portals, creating highly individualized, responsive, interactive, and compliant experiences.

G2 Review: 4.8/5 (122 Reviews)

Strengths: Quadient inspire is renowned for its robust CCM features, intuitive interface, and strong integration capabilities. The software is top notch in creating personalized content and offers excellent support and training resources.

Limitations: Common issues include a steep learning curve for advanced features,performance slowdowns with large documents, and higher pricing that may deter smaller organizations.

GhostDraft CCM

GhostDraft CCM is an insurance industry-specific solution, empowering insurers to manage their communications lifecycle–from content creation to delivery–all in a unified, intuitive environment. This end-to-end solution was designed to address the complexities in insurance, such as creating, managing, and delivering personalized, consistent, compliant communications across multiple channels.

Key Features

1. Pre-Built, Comprehensive ISO & AAIS Content Libraries

The platform provides access to pre-packaged ISP libraries and complete multistate and state-specific form libraries needed for product line updates, ISO-endorsed updates for proprietary forms, or additions.

2. GhostDraft 360–Communication Suite

This all-in-one suite has modules for research, design, filing, specification, development, review, testing, deployment, and execution under one platform.

3. Role-Based Functionality

The centralized hub provides role-based dashboards and workspaces. It is tailored for product managers, compliance officers, business users, and IT professionals.

4. True SaaS Pricing Model

It operates on a flexible subscription model with an all-inclusive annual subscription. There are no hidden fees, and it offers unlimited access to all the features and support.

5. Smart Authoring–MS Word Authoring Environment

The solution can design dynamic templates using familiar tools, embed rules in natural language, and build omnichannel, interactive communications. It handles content and form origination and smart content storage.

6. Real-Time Testing and Review

With intuitive web-based tools, external and internal stakeholders can run batch or regression tests, log issues, simulate documents with test data, and provide feedback, all in real time.

Capterra: 4.0/5 (4 Reviews)

Strengths: GhostDraft is recognized for its ease of use, reliability, and smooth integration with Adapptik. It allows non-IT personnel to manage document markup effectively and excels in generating PDFs from insurance policy data.

Limitations: Users report inexperienced support for Streamweaver integration, occasional upload timeouts, and a learning curve due to its combination of word processing and data markup functions. Some also note that the software is not fault-tolerant, with bad data disrupting print jobs, and request features like a format painter similar to Microsoft Word.

Messagepoint for Life Insurance

Key Features

1. Cloud-Based Intelligent Content Hub

The cloud architecture provides a centralized repository for all communication assets, enabling scalability, rapid deployment, and eliminating the need for on-premise infrastructure.

2. Variation Management Technology

Messagepoint’s patented Variation Management capabilities can generate personalized variations of communications from a single master template based on rules like product type, brand, regulatory jurisdiction, or region.

3. No-Code Content Authoring and Management

An intuitive, code-free authoring environment empowers users to create, modify, and manage communications without IT support. This helps insurers respond quickly to regulatory changes, product updates, or market conditions.

4. AI-Powered Content Optimization

The built-in generative AI capabilities guide content authors in creating clear, consistent, and compliant communications. It also provides real-time feedback on readability, sentiment, and potential brand violations.

5. Messagepoint Connected

Front-office teams, sales, customer service reps, agents, and partners are empowered through omnichannel communications and controlled access to approved, customizable content within CRM systems.

Gartner Review: 4.3/5 (69 reviews)

Strengths: Many report that it provides comprehensive channel coverage, effective marketing capabilities based on customer behavior, and strong integration options for enterprise-wide implementation. Users appreciate its automation features, flexible content management, and responsive customer service.

Limitations: Messagepoint faces challenges with unexpected issues after maintenance updates, slow turnaround times for troubleshooting, and a lack of satisfactory customer support. Users report high costs, dependencies on client-side bug identification, and limitations in email communication. Additionally, the reliance on external composition tools can hinder the rollout of new features and fixes.

Case Study: How Aegon Life Insurance Boosted Market Share with Efficient Communication

Aegon Life Insurance is a leading online-focused life insurer in India with a growing customer base in over 20 countries. It serves approximately 440,000 customers and has successfully increased its market share by enhancing customer experiences through the implementation of a CCM solution.

The Challenge

Despite being a tech-savvy brand, Aegon Life faced critical hurdles in business:

- Outdated legacy systems restrict their agility and operational and integration capabilities.

- Siloed communication processes made it difficult to meet customer needs

- Tracking communication and interactions was not possible

- Clients couldn’t trust claim information that was lacking in transparency

- Aegon’s employees had limited product awareness, making upselling and cross-selling challenging.

The Solution

To overcome these challenges, Aegon Life partnered with a CCM provider to modernize its communication approach. The solution simplified their legacy systems and introduced an agile, unified platform to manage communication across all channels.

CCM platform incorporated dynamic, interactive documents that were highly personalized customer communications. These documents include:

- Personalized policy details

- Real-time clickable buttons for easy navigation

- Highlights of new products, services, and company achievements

- Links directing users to the customer portal and website for deeper engagement

The Results

- Open rates jumped by 70% across email and SMS campaigns.

- Click-through rates increased by 73%, showing higher engagement.

- Customer satisfaction soared, with real-time feedback becoming a key source of insight.

- Digital adoption improved, and customers were more likely to explore additional products and renew their policies.

By adopting an intelligent CCM tool, Aegon Life Insurance upgraded its communications, strengthened customer relationships and trust, streamlined its operations, and positioned itself in this competitive market.

This is a classic example of how the right tool can turn customer communications into a powerful business growth engine. It exemplifies the importance of a robust communication strategy, which you can learn more about in our blog on customer communication management strategy.

Make Communication Your Competitive Advantage in Insurance

People tend to forget that insurance is a promise, not just premiums and policies. Delivering on the promise starts with effective, personalized, and timely communication. Insurance Customer Communication Management does just that, creating meaningful, timely, and compliant interactions at every touchpoint throughout the customers’ journey. From onboarding to renewals, the right CCM software, combined with a robust strategy, turns legalese into loyalty, confusion into confidence, and transactions into trust.

Investing in insurance CCM is a smart way to manage relationships and documents. It’s a win-win situation. From the looks of the current development, we can see that insurance CCM will continue to evolve with greater personalization capabilities, AI-driven content optimization, and deeper integration with core insurance systems.

Regardless of the size of the organization, insurance CCMs are customer-centric solutions that will be capable of meeting the rising demands and standing out in a competitive market. Insurance Customer Communication Management makes every message, every policy letter, and every claim update relatable and easy to digest; it speaks to your customers–not at them.

Is your communication strategy ready for the future of insurance? Check out our blog on Customer Communication Management Strategy.

FAQs

Effective communication is crucial in the insurance industry as it helps build trust, enhances customer satisfaction, and ensures that clients receive accurate information regarding their policies, claims, and renewals. It can significantly impact customer loyalty and retention.

Customer Communication Management is a strategic approach in which organizations utilize systems to create, deliver, store, and retrieve customer communications. The aim is to enhance customer experience (CX) and improve business outcomes. Companies have recognized the impact that customer experiences have on business, including retention rates, sales, and the overall future of the organization

While both Insurance CCM and general Customer Communication Management focus on managing customer communications, Insurance CCM is specifically tailored to address the unique challenges of the insurance sector, such as regulatory compliance, policy information, and claims processing.

When choosing Insurance CCM software, consider factors such as ease of use, integration capabilities, compliance features, customer support, and the ability to personalize communications. It’s also beneficial to look for user reviews and case studies to gauge effectiveness.

Most organizations see 1 to 2 years’ payback periods on their CCM investments. Of course, larger enterprises can expect faster returns due to their scale.

Success can be measured through various metrics, including customer satisfaction scores, response times, resolution rates, and overall engagement levels. Additionally, tracking ROI and analyzing customer feedback can provide valuable insights into the effectiveness of your CCM strategy.

The Ultimate Guide to Customer Communication Management (CCM) Software in 2025

The blog discusses how Customer Communication Management (CCM) software has evolved in 2025, highlig