Top 5 Insurance Broker Software for Policy & Client Management

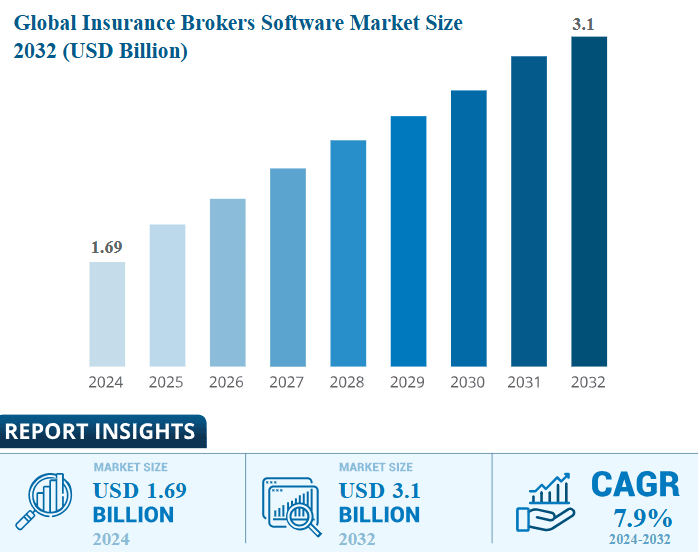

The insurance industry is experiencing rapid growth, and with this growth comes the burden of workload that needs to be managed by insurers. Specifically, the overwhelming number of claims submitted on a daily basis requires attention. Insurance professionals overseeing the claim process, such as claim processors, adjusters, agents, appraisers, and others, require specialized tools. Insurance claims management software is one such tool that helps insurance professionals.

An organization may have a CRM or an insurance suite, but a specialized tool that caters to the requirements and needs in that line of business is not just a strategic advantage but rather imperative. As insurers look to optimize operations, they turn to specialized software, such as insurance underwriting software, insurance analytics software, and insurance verification software. Likewise, this has made insurance claims management software vital for insurers and organizations to transform how they evaluate claims.

Why Do Organizations Need an Insurance Claims Management Software?

Traditional claim processing methods are becoming obsolete; insurers need to rise to the occasion with the transition to a more digitally connected world. Conventional methods often rely on paper-based documents, ledgers, and manual processes. Later, there was a shift to using spreadsheets and computer applications. However, these methods are inefficient, leading to delays in claims processing, a spike in operational costs, poor resource management, and, most importantly, increased customer dissatisfaction.

Want to Generate Documents In Bulk ?

With Perfect Doc Studio, you can simplify bulk document generation in over 100 languages with its intuitive drag-and-drop interface. Our advanced features allow businesses to create, customize, and distribute personalized communications across global markets.

Now, technology is pervasive in the insurance sector, with insurtech innovations leading the way to the insurance industry’s future. Although technological integration and innovation might seem obvious, many organizations are reluctant to embrace these changes. A survey conducted by Accenture reported that a least 75% of insurance executives believed insurtech innovation would benefit the company, but only 44% of them actually use such technology in their claims processes.

AMS 360 is a foundational agency management system designed with large-scale insurance agencies in mind. It caters to multiple lines of business, including specialty lines, with built-in accounting features and role-based permissions. Vertafore has three AMS, namely QQ Catalyst, AMS360, and Sagita. AMS 360 stands out amongst its competition due to its robust integration capabilities and scalability, driving sustainable growth and delivering excellent service.

Key Features

- Client management features include email and text communications through AMS360 Messenger, an around-the-clock self-service portal for clients through InsurLink, and the ability for business users to access client information through AMS360 Mobile.

- The comprehensive policy management features cover carrier downloads (policy data updates, status information, and direct bill commissions) and manage all policy documents.

- The core integrations offered by AMS360 are AMS360 Messenger, PL Rating and its Add-ons, DocuSign, Reference Connect, and InsurLink; apart from that, it has 40+ third-party integrations available.

- The platform utilizes QQ Catalyst for its accounting, manages trust reporting, and segments revenue and expenses by 3 categories: location, business units, and specialty niche.

- Business intelligence provides an analysis of growth patterns, financial reporting, and benchmarking of market trends.

- AMS360 is an integrated accounting solution that automates billing, invoicing, and commission calculations.

Benefits

My Agency Reports: AMS360 provides detailed insights into employee productivity, policy management, and conversions. Additionally, it also allows users to customize reports and includes pre-configured reports.

My Agency Home: The platform helps users service clients through adaptable guided workflows and a customizable dashboard. It also includes built-in regulatory compliance tools.

Vertafore Single Sign-on (SSO): Vertafore enables business users to access all Vertafore solutions without requiring multiple credentials.

TransactNOW: Through TransactNOW, business users can receive eDocs and messages. It also allows real-time transaction workflows and instant sign-on carrier websites.

Financial Capabilities: AMS360 simplifies month-end processes with general ledger functionality. It also ensures adherence to compliance for all financial records and utilizes specialized tools for managing regulated client funds.

Jenesis Insurance Agency Management System is a web-based insurance broker software designed to address the major challenges faced by insurance brokers. Jenesis aims to ease client communication and policy management, as well as the planning and launching of marketing campaigns, by integrating essential tools and capabilities into a unified, user-friendly platform.

Key Features

- Client management features include a 24/7 self-service client portal with access to policy documents and certificates of insurance, notes system capability to search for specific client-related documents, and managing different types of media (logos, certificates, etc.)

- Jenesis has extensive document management and processing capabilities, consisting of ACORD Forms Library, integration with e-signature, and automatically generating insurance certificates.

- The platform supports carrier downloads for both commercial and personal lines from most U.S. insurance carriers and allows single-click access to a carrier’s website.

- Jenesis identifies opportunities for revenue growth through targeted marketing campaigns and cross-selling through client data analysis. It also tracks commissions through the commission manager.

- The suspense feature handles time-sensitive tasks and issuing reminders. For policy renewals, the platform automates reminders as well.

- Jenesis adheres to compliance; it provides documentation of all client communications, audit trails for all transactions, and secures client data.

Benefits

Training and Support: Jenesis’s certification program trains business users to use the platform optimally. The solution also provides dedicated ongoing support from industry experts.

Employee Productivity: The platform monitors employee productivity, transactions, and clock-in and clock-out times.

Communication Integration: The solution integrates two-way email and text so clients can communicate directly from the software’s interface. With VoIP integration, users can also make and receive calls using the software.

Accounting Integration: With QuickBooks’ integration, Jenesis handles invoicing and payment tracking. It is also equipped with credit card functionality and can process credit card payments.

HawkSoft is a cloud-based Insurance Agency Management System that uses strategic insurtech as its foundation, equipping users with the tools and technologies required to meet clients’ evolving demands. HawkSoft is a system designed by agents, with over 25 years of experience, for other agents and covers both commercial and personal lines.

Key Features

- The solution has cloud-based capabilities that extend to PC, android, iPhone, iPad, laptop, or desktop (full feature access), providing a comprehensive experience by not compromising on essential features.

- HawkSoft automatically downloads carrier policy and coverage updates; it also gives users an opportunity to either update the policy immediately or allow users to review the changes before the update.

- A unified client profile architecture provides access to all the relevant information, and HawkLink helps quickly process changes, payments, and quotes by integrating with carrier websites.

- HawkSoft’s Proprietary Action Menu builds documentation automatically during the execution of workflows. Additionally, the platform automatically documents all client interactions to reduce the chances of errors and omissions.

- HawkSoft’s AMS is integrated with QuickBooks for operational accounting; with built-in accounting workflows, trust accounting, and commission management; it also streamlines commission processing with Excel and CSV import capabilities.

Benefits

Agency Intelligence: The platform’s reporting suite offers one-click reports for Book of Business, retention, sales pipeline, and cross-sell metrics under one platform.

ACORD Forms: The built-in library of ACORD forms with intelligent pre-fill capabilities from HawkSoft data and updates the current versions of P&C ACORD forms.

Virtual Printer: A PDF writer tool captures any website image, screenshot, or document and adds it to the policyholder’s file, simplifying the document attachment process for a broker.

Batch and Email Marketing: The platform helps with scheduling and sending emails to lists generated by Agency Intelligence, giving users the opportunity to either market to the whole book of business or specific groups.

Sales Capabilities: The platform customizes sales proposals that can be edited, captures leads from the website using forms to import data into HawkSoft and provides actionable sales pipeline reports.

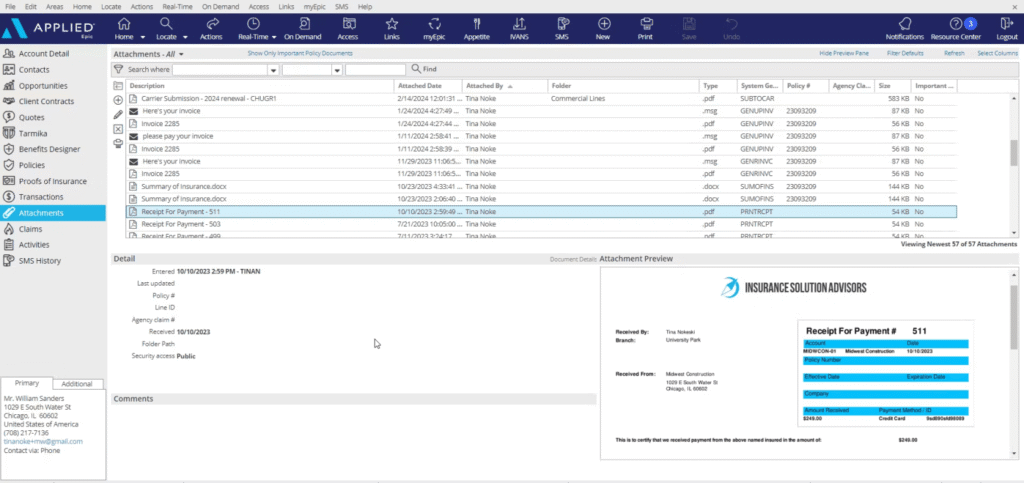

Applied Epic is an insurance broker software designed as an out-of-the-box management platform that handles policies, customer relationships, documentation, insurer connectivity, and more on a unified system. This browser-native solution is the world’s most widely used insurance broker management platform for its holistic approach to brokerage and the comprehensive functionality it offers.

Key Features

● The platform uses an open, scalable architecture through an API and Data Lake Design, supporting the acquisition and integration of both third-party and applied applications.

● The platform integrates with Salesforce’s CRM technology, monitoring, tracking, and forecasting new business opportunities and renewals. For quotes, it integrates with Epic Quotes for commercial lines.

● Documents are security managed, taking into account the business guidelines or the organization’s customized process by enabling simple or deep folder hierarchies.

● Applied Epic centralizes document management with secure data handling and role-based access controls. The platform reduces security risks through audit trails, version control, and standardized compliance processes.

● Applied Epic provides real-time reports and insights into sales trends, revenue recognition reporting for premium and commission tracking, and analysis of customer portal usage.

● The solution integrates eTrading so brokers can eliminate the data entry process and exchange data directly with insurers.

Benefits

Renewal Management: Applied Epic’s broker system lets you view and track all renewals, including EDI, Manual, and Scheme policies for all lines of business.

Omnichannel Customer Service: The platform offers self-service options for customers through a portal and an around-the-clock mobile application to obtain quotes and look up policy details.

Commission Tracking: The solution processes direct-bill commissions without premium entry requirements and calculates premium-weighted commissions to optimize revenue.

Insurer Connectivity: Automated information exchange ensures users receive the most updated policy-related documents straight to your managing system.

Process Automation: Automated workflows are adapted for commonly used workflows; the system also includes business process management capabilities and pre-built workflows.

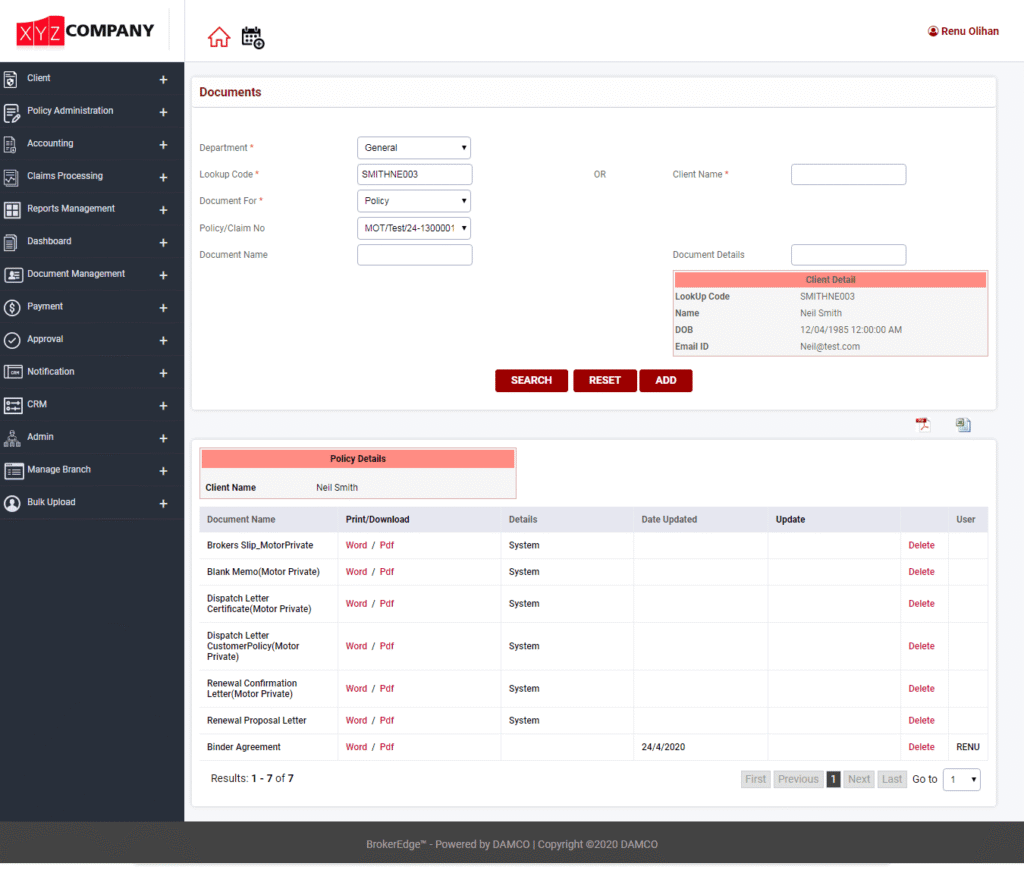

BrokerEdge is Damco’s insurance broker software designed with the goal of enhancing productivity without compromising sales and revenue. The solution supports the complete fronting and co-brokering accounting processes, promoting expansion into new or even global markets. By integrating critical brokerage functionalities, the platform helps brokers to manage their operations on a unified platform.

Key Features

- The solution can be configured for various insurance companies and products. It also covers various lines of business, supporting over 38 LoBs across Property & Casualty, Specialty, Liability, Life & Health offerings.

- BrokerEdge’s policy lifecycle includes quoting, endorsements, renewals, and cancellations. With automated renewal notice notifications and automated as well as manual rate management capabilities, brokers can easily manage core operations.

- The platform facilitates real-time data exchange with insurer systems through API or EDI and offers communication channels with multiple carriers.

- A single-view dashboard that can be accessed on both mobile and web platforms to provide access to critical information instantly. The dashboard interface presents all standard and statistical reports.

- Multiple quotes can be compared on the platform through API or Excel uploads and offers digital policy buy out.

Benefits

Sales and CRM: BrokerEdge handles the entire end-to-end processing from head creation to closing. It also promotes cross-selling and upselling.

Producer Portal: The producer portal has business registration capabilities, a commission management system, and configurable agent or producer sections.

Customer Portal: The 27/7 self-service portal helps customers with digital claim submissions that allow for photo and video upload functions. Additionally, the platform has integrated payment processing and profile management capabilities.

Compliance and Security: The platform includes security measures, such as multiple layered access controls, GDPR compliance, and industry-based encryption protocols.

Subscription-Based Model: The platform supports an unlimited number of users and utilizes a pay-as-you-go model that can be scaled.

Worried about compliance? Navigate compliance challenges with insights from our blog Insurance Compliance Software.

Conclusion

There are various benefits of using an insurance broker software, and it’s high time brokers all over the world adopt such insuretech solutions that would aid their jobs. This is crucial as customers prioritize exceptional service; the future of a successful insurance broker isn’t just about the long list of his or her clients but rather how they can leverage technology to provide the best possible coverage options and personal guidance. After all, most people prefer brokers over agents because of their unbiased guidance.

The insurance industry’s primary goal has been to safeguard against uncertainty; with that in mind, investing in an insurance broker software is not just a fleeting trend but an imperative for those committed to long-term success.

Top-Rated P&C Insurance Software for SMB And Enterprises

Understand the P&C insurance landscape and explore key functionalities and leading software options

Evolution of Insurance: A Guide to Leading Software Solutions

This blog delves into the evolution of insurance software, highlighting key innovations and top soft

Find the Perfect Insurance Underwriting Software for Risk Assessment

Insurance underwriting is the cornerstone of any policy. Learn about the latest trends and features