Top 5 CCM Platforms for Insurance in 2026: A Comprehensive Comparison Guide

Customer Communications has never been more important than today in any industry. More so in the insurance industry, where they send various customer notifications and communications daily. Whether it is policyholder engagement, claims processing, billing, and onboarding, customer communications management has become the backbone of insurance documentation.

The global Customer Communication Management (CCM) market for insurance is projected to grow from $2.3 billion in 2024 to $6.7 billion by 2033, reflecting a CAGR of 12.5%. This growth is due to the highly competitive nature of insurers, and offering a superior customer experience has become a key competitive advantage for securing more clients. The results? Investment in advanced CCM platforms is emerging as a strategic priority.

Key Takeaways:

● CCM is a crucial part of insurance communications. It drives compliance, customer engagement, and operational efficiency.

● Insurers today need CCM capabilities such as multichannel delivery, native insurance system integrations, compliance, and analytics to deliver a superior customer experience.

● No-code/low-code tools are the future as the number of business users increases, and there is a need to reduce IT dependency to enable faster template creation and updates.

● The compiled list of top CCM tools supports insurance workflows like policyholder notifications, claims correspondence, and billing, with key strengths ranging from global language support (Perfect Doc Studio) to market presence and scalability (Quadient, OpenText).

● Strategic selection of CCM platforms should align with research on what an organization’s growth objectives and needs are, regulatory demands, IT capabilities, and the total cost of ownership for long-term value.

Selecting the right CCM so it can serve as the backbone of digital transformation initiatives, enabling insurers to design, manage, and deliver personalized communications across multiple channels. As policyholder experience has become a differentiator, insurers either risk falling behind in this competitive era or equipping themselves with technology to increase their revenue.

Why CCM Matters for Insurance in 2025

Insurance companies use CCM for a variety of reasons, but essentially, the following factors are what make a good CCM platform ideal for insurance.

● It ensures compliance with stringent regulations like HIPAA, GDPR, and industry & jurisdiction regulations.

● It integrates with core insurance platforms like policy administration, claims, billing, and CRM systems to offer a single place for all your customer communications.

● CCM’s core capability is multichannel communications (email, SMS, print, web portals), the need of the hour in this digital era.

● Many CCM platforms offer a low-code interface or template editing, and some even offer a complete no-code interface like Perfect Doc Studio.

● With real-time tracking and analytics for communication effectiveness, KPIs and metrics can be derived to optimize business offerings and operations.

● Complex documents and workflow management unique to insurance offer unprecedented automation that eases many of the manual tasks.

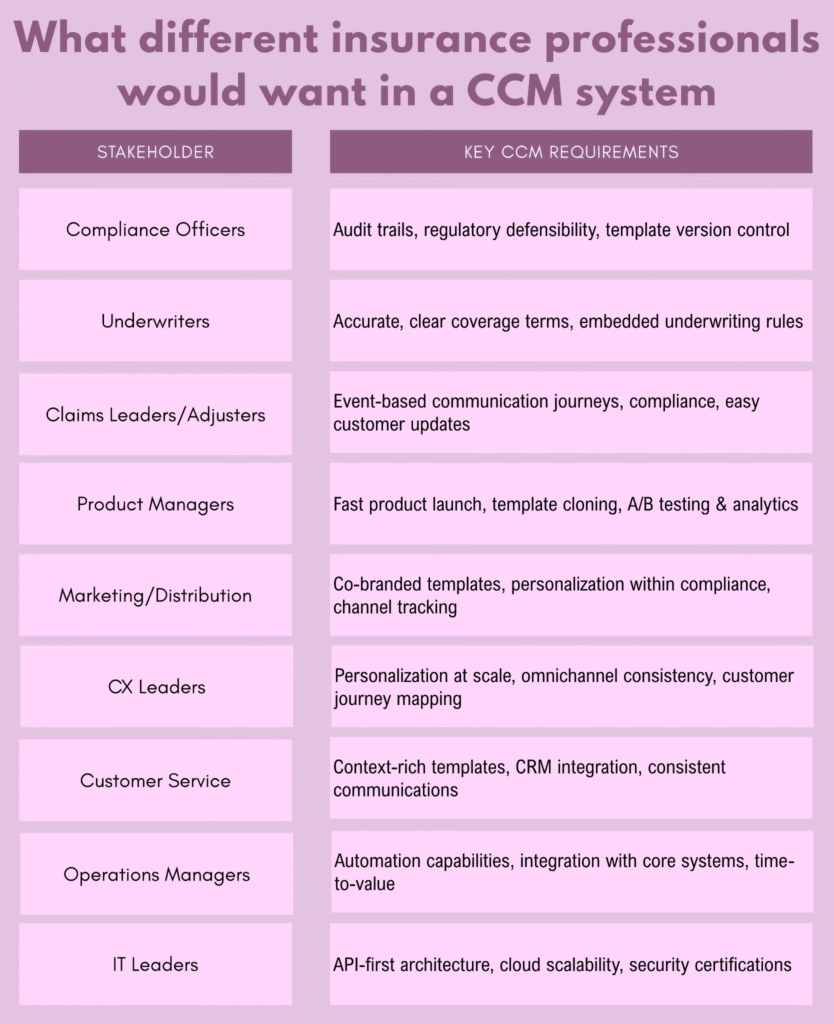

What Insurance Professionals Look for in CCM

Different stakeholders value different aspects of CCM. Finding the right CCM tool for your organization requires decision makers to evaluate CCM platforms across several critical dimensions. Below are some factors to consider:

Finding a platform that meets everyone’s criteria is key. That is why this guide offers an objective, side-by-side evaluation of the leading CCM platforms serving the insurance sector.

Top 5 CCM Platforms for Insurance: In-Depth Profiles

Perfect Doc Studio – Accessible Enterprise Power

Perfect Doc Studio (PDS) is a true business-user-friendly tool that delivers enterprise-grade CCM at a significantly lower cost than any other enterprise solution on the market. It is well-suited for insurers seeking document automation and CCM capabilities without the complexity of enterprise solutions. What makes Perfect Doc Studio different from the rest of the tools on the market is its language localization capability, which supports 192 languages, making it the ideal tool for global insurers.

Key Features for Insurance:

1. No-Code, Drag-and-Drop Builder: PDS allows business users to create, edit, and manage templates without any IT dependency.

2. 192 Languages Support: It supports translations in 192 languages and even offers localization of the entire tool in 108 languages. Apart from that, PDS’s team has curated 1200+ to match the 108 languages.

3. Native Insurance System Integration and Migration Engine: Pre-built connectors for insurance core systems like Guidewire, Sapiens, and Duck Creek. PDS’s native integration engine eliminates the need for third-party systems like Zapier, saving you integration support and money. Additionally, the migration engine aids the transition of templates from any system.

4. Centralized Analytics: The platform provides actionable insights for documents, emails, messages, and calls on communication effectiveness and customer engagement. With Job Monitoring capabilities, insurers can also track their batch processing tasks and workflows. All this would help them optimize their business operations.

5. Automation Capabilities: PDS automates the entire process of sending out documents, emails, or messages. Through the integration, the system automatically fills in the data on the templates and sends it out for approval. With PDS, you can configure workflows that can include any type of STPs, SFTPs, databases, or business systems (sometimes even multiple systems) without the need for APIs.

6. Enterprise Scalability: It can handle millions of communications with enterprise-grade scalability through Kubernetes and can horizontally scale as your organization’s needs grow.

Insurance-Specific Capabilities:

● Conditional logic and business rules adapt content based on policy types and coverage amounts. For example, if the policyholder is a senior citizen, the policy would automatically include coverage details and terms for senior citizens.

● GDPR, HIPAA, and ISO compliant with enterprise-grade security, with options like Single Sign On (SSO) and Role-Based Access Control (RBAC).

● PDS supports omnichannel delivery with options for email, short messages including SMS, WhatsApp, and voice calls, print automation, and custom storage options including S3, Azure, GCS, private cloud, or on-premises.

● There are reusable sections in a centralized content hub that you can either clone and customize for individual documents or use auto-update features for Propagation. For example, standardized blocks of content, clauses, or templates that are frequently reused, such as General Exclusions, Conditions and Obligations, Confidentiality and Data Usage Clauses, Renewal Provisions, and more.

● Dynamic elements enhance documents visually using Data-Driven Charts & Tables, such as personalized premium vs. coverage charts for customers, Embedded Visuals (adding images, icons, or logos dynamically), and Barcodes & QR Codes (scannable codes for payment, verification, tracking, or linking to digital content). All of this can be done with just a few clicks.

Considerations:

● As the product is newer to the market than some of its long-standing competitors, it has a smaller market presence.

● Custom configurations and implementation for an enterprise might take a few weeks.

Best For: It is ideal for insurers of any size due to its transparent pricing and organizations seeking rapid implementations without enterprise complexity.

Quadient Inspire – The Market Leader

Quadient has the largest CCM market share at 11% according to IDC’s 2024 CCM report and is trusted by three of the top four U.S. insurance companies. Quadient is a low-code editing and strong compliance tool that can futureproof communications with cloud accessibility and versioning. This makes it suitable for dynamic interactions with policyholders.

Key Features for Insurance:

1. Inspire Xpress: With AI-powered template migration, Quadient reduces legacy system transition time and costs through machine learning, AI, and NLP. This easily transforms your old communications into new content and templates.

2. Inspire Flex (For on-premise and hybrid solutions): It offers compliant omnichannel experiences to policyholders, agents, and brokers. Business users can use one centralized hub: Statements, email, SMS & push notification, mobile and web portal content, digital forms & claims correspondence, quotes, policies, riders & welcome letters.

3. Inspire Journey: The platform orchestrates journeys by integrating customer journey mapping, and data & communications. This provides a clear visual representation of customer interactions across all omnichannel communications.

4. Inspire Evolve (Only for cloud-based CCM): A centralized hub with four key components: Content Author (a design service), Front Office (personalize communications), Generate (composition and delivery of communications), and Archive (configurable long-term archival and retrieval capability).

Insurance-Specific Strengths:

● It includes pre-built integrations with insurance core platforms like Duck Creek and Guidewire.

● The platform provides granular control over content with a complete audit trail and business rules for jurisdiction-specific regulatory content.

● Quadient Inspire offers flexible implementation options, including SaaS, on-premise, hybrid, and cloud.

● The Digital Advantage Suite enables the creation of responsive, interactive, regulatory-compliant, and highly individualized mobile and web portal content through a centralized, intuitive interface.

● Inspire provides access to content blocks through a web browser, and its template-based design allows business users to create, modify, and manage communications without burdening IT.

Considerations:

● There is a steep learning curve, and users benefit from expert implementation support.

● The pricing is significant even for enterprises, as the cost is determined based on the deployment model, scope of use, migration, and many other indirect costs. IT is definitely unsuitable for small and medium insurers.

● There is always a need for a Quadient specialist team for customizations, development, and management.

Best For: Mid to large insurers undertaking digital transformation with complex omnichannel requirements.

Below is the customer testimonial of LALUX Assurances, an insurance company based out of Luxembourg

G2 Reviews 4.8/5.0 (122 reviews)

Strengths: Common strengths across many reviews include flexibility and personalization (users value the ability to create highly customizable, personalized documents across channels), automation and efficiency improvements, and omnichannel delivery (a clear advantage for high-volume output generation in a CCM tool). Others also value the system integrations, which minimize errors and streamline workflows.

Weaknesses: About 60% of reviews highlight a steep learning curve and complex, time-consuming setup, especially for new users who need significant training and meet initial requirements. Implementations tend to be lengthy, particularly when custom requirements are involved. Users also emphasize the high costs and resource demands, such as expensive licensing and training, along with the need for robust hardware and skilled specialists.

Smart Communications SmartCOMM – Cloud-Native Agility

Smart Communications is renowned for its cloud-native architecture and for empowering business users. In 2024, it was named a Luminary in Celent’s CCM Solutions: Global Insurance Edition. The entire platform excels in personalization and omnichannel delivery but is pricier, suitable for insurers prioritizing customer experience and innovation.

Key Features for Insurance:

1. Single Template Approach: One template serves all channels, making it simpler for business users to update as regulations change.

2. Manage Compliance and Risk: The platform offers role-based content editing permissions with complete audit trails and change tracking. It is also a HIPAA and ISO 27001-compliant platform.

3. True Cloud Deployment: On-premise deployment includes pure cloud on AWS, offers elastic scalability, 99/99% uptime target, and continuous delivery.

4. Integration with Core Systems: SmartCOMM has its own products: SmartCOMM for Salesforce, SmartCOMM for Guidewire, SmartCOMM for Pega, and SmartCOMM for Duck Creek. Additionally, it connects directly to the insurer’s core administration processing systems.

5. Business User-Friendly Interface: Simplified template management offers browser-based editors with simple drag-and-drop design, which embeds interactive components such as images, videos, social media toolbars, and accordion widgets. It also provides easy-to-use interfaces for real-time previews, approvals, and editing.

Insurance-Specific Strengths:

● The personalized, intelligent, adaptive forms are clearer, more concise, and timelier than any traditional forms of communication. This aids in the process of onboarding, activation, and enrolment of customers.

● The migration studio capabilities support users in extracting existing content from PDF and text documents in legacy systems into SmartCOMM using ML and AI.

● It offers interactive communications with on-demand and batch processing options delivered to any channel from traditional print-based communications to web, email, SMS, and mobile & voice assistant.

● SmartComm offers an intuitive experience for insurance managers (handling billing, policy, and claims), template authors (to design and manage templates with access to shared content, styles, and layouts), and insurance agents (to customize on-brand communications).

Considerations:

● Cloud-only deployment may not suit highly regulated environments requiring on-premise data control.

● The platform is less suited for deep backend complexity or legacy system entanglement.

● It struggles with highly customized document logic and legacy data dependencies.

There would be challenges when dealing with highly regulated documents or high-volume transactional output, both of which are crucial in the insurance domain.

Best For: Most suitable for digital-first insurers prioritizing speed, cloud deployment, and CX innovation.

Below is a SmartCOMM demo which describes the FNOL and Customer Communications process.

G2 Reviews 4.7/5.0 (23 reviews)

Strengths: Reviewers talk about common CCM benefits like reduction in errors and time for document drafting. There are those who mention robust integrations and stability, positively describing stabilization experiences. Others also reference powerful features like flexible XML structure, change management, and comprehensive capabilities without proprietary scripting.

Weaknesses: Some reviews complain about ongoing stabilization rather than fully mature deployments, but others indicate satisfaction post-setup. There is an initial learning curve for mature feature sets that can be challenging for new users and requires some time to master.

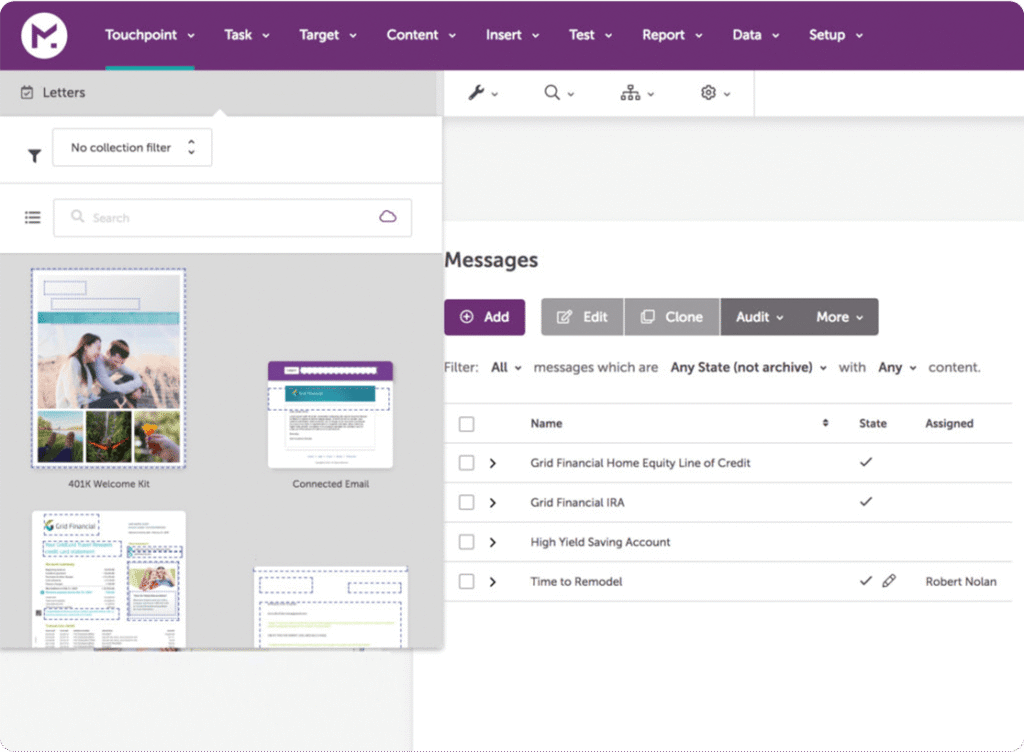

Messagepoint – AI-Powered Content Intelligence

Messagepoint offers intelligent approaches to migrating, authoring, optimizing, and managing content, including no-code control for business users and headless CCM architecture for developers. It was awarded the Luminary ranking in Celent’s 2024 CCM Solutions report for the second consecutive year, and has been a leader in the Aspire CCM leaderboard for seven consecutive years.

Key Features for Insurance:

1. MARCIE AI Engine: MessagePoint’s proprietary AI for content analysis, rationalization, optimization, and translation. It also helps with content migration.

2. AI-Powered Translation: The platform uses Gen AI to translate with AI translation accuracy checks and complete visibility and control through the QA module. It breaks documents into content components, translates them, and sends them out for approval.

3. Modular Content Management: The modular approach (with reusable content) to content management enables a content object (containing text or an image) to be centrally shared and managed across multiple touchpoints and channels.

4. Integration with Core Systems: SmartCOMM has its own products: SmartCOMM for Salesforce, SmartCOMM for Guidewire, SmartCOMM for Pega, and SmartCOMM for Duck Creek. Additionally, it connects directly to the insurer’s core administration processing systems.

5. Business User-Friendly Interface: Simplified template management offers browser-based editors with simple drag-and-drop design, which embeds interactive components such as images, videos, social media toolbars, and accordion widgets. It also provides easy-to-use interfaces for real-time previews, approvals, and editing.

Insurance-Specific Strengths:

● Healthcare Touchpoint Exchange is purpose-built for Medicare Advantage ANOC, EOC, and SB documents

● With variation management and template reuse capabilities, it reduces the number of touchpoints under management.

● Messagepoint’s SmartText allows content authors to share content across communications. Moreover, it reduces redundancies, aids the management of content in a master template, and updates instantly across all related touchpoints.

● Messagepoint supports versioning and history comparisons by storing older versions of your messages and highlighting additions, deletions, and style changes across versions.

Considerations:

● Primarily cloud-based and offers deployment on either their cloud or your cloud server, with limited on-premise options.

● Apart from Messagepoint, you may be required to get complementary solutions for certain use cases.

● Pricing is not publicly available, but reviews claim it is significantly high.

Best For: It is ideal for content-heavy insurers managing complex, multilingual, and highly regulated communication who are comfortable with cloud-only deployments.

Below is a video that describes Messagepoint’s AI powered communication works:

G2 Reviews 4.1/5.0 (4 reviews)

Strengths: The Majority of the reviews state strong support for customers interaction and service functions. Small organizations note that Messagepoint offers comprehensive service.

Weaknesses: The only weakness highlighted in all the reviews is the steep learning curve, which requires users to learn navigation and full functionality despite onboarding hurdles.

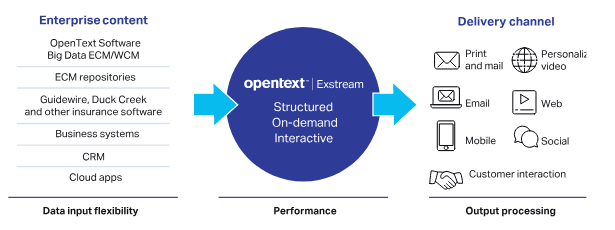

OpenText Communications (Exstream) – Enterprise-Grade Stability

OpenText Extream is a CCM solution with intelligent tools like knowledge-driven GenAI, advanced orchestration, and assured message delivery across every channel. The platform is favoured by those who already use the OpenText ecosystem and is particularly deployed across government, utilities, and heavily regulated industries.

Key Features for Insurance:

1. Content Authoring: Non-technical users can modify and publish content in OpenText Extream templates without IT help, and easily manage variation in the repository. It offers AI-assisted authoring with sentiment analysis and readability capabilities according to the Flesch Reading Ease scale.

2. Web-Based Design: The platform allows users to control editable areas based on user role or responsibility within a single communication. It supports multiple devices, browsers, and environments with existing back-end processing for creating and managing communications.

3. Deployment Options: The platform is a fully containerized solution optimized for cloud deployment. It can also be deployed as a hybrid model or on-premises, in the customer’s own data center, or on a chosen hyperscaler such as AWS, Azure, GCP, or the OpenText Cloud.

4. OpenText Aviator: Aviator (knowledge-driven GenAI) connects to your business content like policies, claims, documents, and transcripts, providing outputs that are accurate, secure, and tailored to a customer’s journey, ensuring brand guidelines are consistent.

5. Omnichannel Architecture: It is an enterprise CCM solution that includes messaging, customer journey and data, web and mobile experiences, digital asset management, and contact center analytics.

Insurance-Specific Strengths:

● The operational dashboard within the system monitors throughput, delivery status, and system performance in real-time, supporting business users to make data-driven decisions.

● The system is integrated with leading business apps and ecosystems, such as SAP, Salesforce, Guidewire, and Duck Creek, to name a few.

● Its DMS-centric infrastructure supports document retention, permission, and RBAC that aptly solve the insurance industry’s legal and compliance-related issues.

Considerations:

● The pricing is higher than most other CCM solutions on the market.

● Configuration and development are heavily reliant on IT support, with limited room for rapid iteration by business teams.

● There is a consistent need for OpenText experts or specialists on your team to make optimal use of the product or to make modifications.

Best For: It is suitable for large-scale enterprises with complex legacy infrastructure and strict on-premise requirements, willing to invest in maintaining the communications platform.

Below is a video that details how OpenText’s Exstream’s CCM tool functions:

G2 Reviews 4.6/5.0 (9 reviews)

Strengths: The design and workflow setup are considered intuitive. The platform supports HTML and responsive email design compared to manual HTML coding.

Weaknesses: Users mention problems with importing documents, such as Word files, into the design studio, including font issues when copying and pasting from business documents. Several users note that certain limitations around document handling and import need more efficient resolution.

| Feature / Criteria | Perfect Doc Studio (PDS) | Quadient Inspire | Smart Communications SmartCOMM | Messagepoint | OpenText Exstream |

|---|---|---|---|---|---|

| User Friendliness | No-code, drag-and-drop builder, business-user focus | Low-code editing requires expert support | Browser-based drag-and-drop, business-user friendly | Browser-based, drag-and-drop with AI assistance | Non-technical authoring, but IT-heavy |

| Language Support | 192 supported languages, 108 localized UI languages | Limited language/localization info | Standard multilingual support | AI-powered translation & AI QA | Supports multiple languages with compliance focus |

| Integration | Native connectors for all business applications, including Guidewire, Sapiens, Duck Creek; no 3rd party needed | Pre-built integrations (Duck Creek, Guidewire); SaaS/on-prem/hybrid | Integrates with Salesforce, Guidewire, Pega, Duck Creek | Connects to core systems; modular content management | Integrates SAP, Salesforce, Guidewire, Duck Creek |

| Automation & Workflows | Fully configurable; no APIs needed for STPs, SFTP, or databases | Journey orchestration, compliance controls | Event-driven, omnichannel batch/on-demand | AI content optimization, reuse, variation management | Orchestration, AI-driven authoring, GenAI-powered |

| Scalability | Enterprise-grade with Kubernetes horizontal scaling | Flexible deployment options (SaaS, hybrid, on-premises) | Cloud-native, elastic scalability | Cloud native, limited on-prem options | Enterprise-grade, hybrid and on-premise deployments |

| Compliance & Security | GDPR, HIPAA, ISO compliant; SSO and RBAC | Granular control, audit trails, and regulatory compliance | HIPAA, ISO 27001 compliant with audit trails | Comprehensive versioning, compliance focus | Full security, RBAC, and compliance built in |

| Insurance-Specific Features | Conditional logic for policy types, reusable clauses, and omnichannel delivery | Centralized hub for policyholder comms, compliant omnichannel | Intelligent adaptive forms, migration studio | SmartText for content reuse, healthcare-specific docs | Knowledge-driven GenAI for journey personalization |

| Pricing & Market Presence | Transparent, cost-effective, newer product | Expensive, established leader, steep learning curve | Premium pricing, suited for digital-first insurers | Pricing high, cloud-centric, content-heavy insurers | High cost, IT-dependent, suited for large enterprises |

| Best For | Insurers of all sizes need rapid, agile implementations | Mid to large insurers with complex omnichannel needs | Digital-first insurers focusing on CX innovation | Content-heavy insurers managing multilingual comms | Large enterprises with legacy systems and strict compliance |

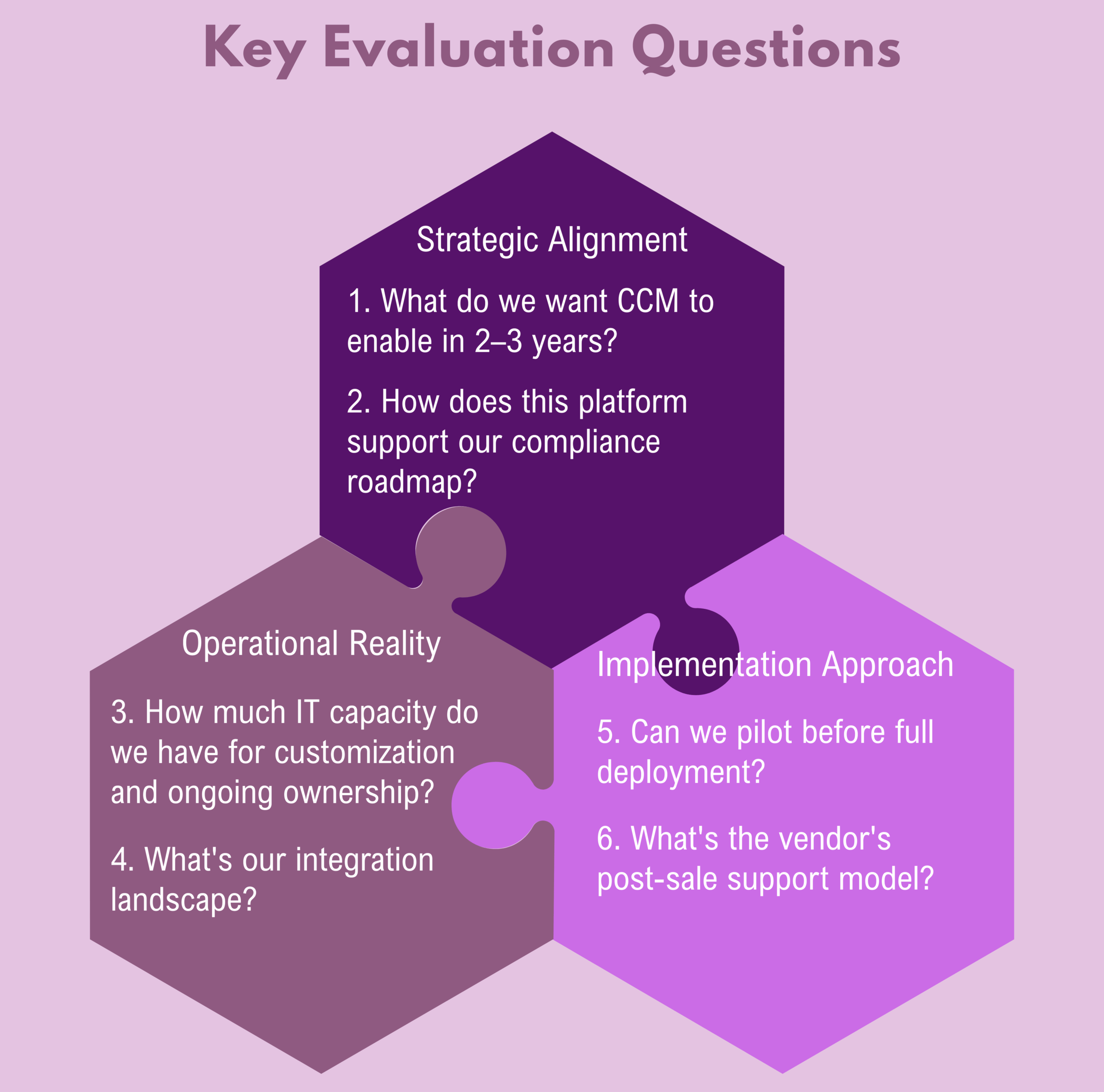

Key Evaluation Questions Before You Decide

Here are some critical questions you must consider when you are considering a CCM platform for your business.You can use a strategic checklist before selecting a CCM platform.

Strategic Alignment

1. What do we want CCM to enable in 2-3 years?

Consider growth plans before deciding which type of CCM to invest in. First, understand your expectations, needs, transformational goals, and CX objectives. If you have a clear picture of these, half the work is already done; all that’s left is choosing a CCM tool that helps you achieve them.

2. How does this platform support our compliance roadmap?

Different types of insurance require compliance with specific regulations, not to mention there are also state-specific requirements. Many tools follow more common regulations like EAA or GDPR. Find a tool that fits your industry and domain.

Operation Reality

3. How much IT capacity do we have for customization and ongoing ownership?

There are many platforms that require significant internal resources like OpenText or Qudient. If your organization can invest in such resources, you can buy these tools. But if it can’t, choose tools that are designed for business user self-service.

4. What’s our integration landscape?

If you are not an organization that uses common insurance business systems like Guidewire or DuckCreek, then you will need to evaluate how the tool maps connections to policy admins, claims, billing, and CRM systems. Perfect Doc Studio’s native integration engine can handle this with its automated workflow, which can be configured without involving any third-party service.

Implementation Approach

5. Can we pilot before full deployment?

It’s always best to pilot the product before deciding to invest in it. Start with low-complexity tasks and gain quick wins before investing.

6. What’s the vendor’s post-sale support model?

Speak to companies that are using the product to understand what kind of training, migration support, and roadmap transparency they offer, so you know what you can expect in the long run.

Recommended Actions:

1. Shortlist 2-3 platforms after asking yourself the above questions, deployment preferences, and integration requirements.

2. Request tailored demos focusing on your specific insurance use cases

3. Conduct pilot projects with low-complexity communications before enterprise-wide rollout.

4. Assess the total cost of ownership, including licensing fees, implementation costs, training, and ongoing maintenance.

Ready to transform your insurance communications? Explore how Perfect Doc Studio delivers enterprise-grade document generation and CCM capabilities. Try the lifetime freemium version!

Conclusion

For insurance companies seeking the best CCM platform, this comparison highlights the essential features, user sentiment, and business fit. While OpenText, Quadient, and Smart Communications remain strong contenders for large enterprises with extensive compliance needs, Perfect Doc Studio emerges as a highly valuable platform balancing power, ease of use, and cost-efficient innovation tailored to insurance.

Building your CCM strategy around such an informed choice will drive improved policyholder experiences, compliance confidence, and operational excellence.

FAQs

CCM in insurance refers to systems designed to manage, create, deliver, and track customer communications across channels such as email, SMS, print, and web portals, ensuring compliance, improved policyholder engagement, and operational efficiency.

CCM helps insurers meet policyholder expectations for timely, personalized, and compliant communications. It supports digital transformation, enhances customer experience, enables regulatory compliance (GDPR, HIPAA), and integrates core systems for seamless communication management.

Insurance professionals seek platforms with compliance assurance, integration flexibility, scalability, omnichannel delivery, and user-friendly interfaces—ideally no-code or low-code for document creation, plus robust analytics and automation capabilities.

Modern CCM solutions provide audit trails, version control, standardized templates, and jurisdiction-aware business rules to ensure every customer communication meets strict regulatory requirements and reduces legal risks.

Consider strategic alignment, compliance roadmap support, IT customization capacity, integration landscape, ability to pilot before deployment, and vendor support. Matching platform strengths (e.g., scalability, cost, ease-of-use) to organizational priorities is critical.

CCM streamlines communications, enhances content personalization, and supports multichannel engagement, leading to increased customer retention, faster onboarding, fewer call volumes, operational savings, and improved cross-sell/up-sell opportunities.

5 Ways Content Localization Improves Global Customer Experience

When entering new markets, what sets a brand apart? Localization. To ensure a successful market entr

Maximizing Engagement: The Benefits of Customer Communication Management(CCM)

Explore the many advantages of customer communication management! In this blog, we discuss the busin